Table of Contents

Welcome to the One Card Detailed Guide:

If you’re looking for a credit card that’s modern, powerful, and truly made for today’s generation, then you’re in the right place. The One Card Credit Card isn’t just another card in your wallet — it’s a blend of premium metal design, smart technology, and complete transparency.

In this blog, we’ll help you decode everything about One Card — from its features, benefits, and rewards to eligibility and how to apply. Whether you’re a first-time credit user exploring your options or someone who’s already familiar with cards but wants something simpler, smarter, and lifetime free, this guide will give you every answer you’re looking for.

What is One Card Credit Card?

The One Card Credit Card is a modern financial product managed by FPL Technologies Pvt. Ltd., a Pune-based fintech company. FPL Technologies currently offers three major products in the Indian market — One Card, One Score, and Wizely — each focused on helping users build better financial awareness and control.

The itself is a co-branded, next-generation metal credit card designed specifically for digital-first users. It is issued in partnership with leading Indian banks such as Bank of Baroda, CSB Bank, Federal Bank, Indian Bank, SBM Bank, and South Indian Bank.

As per RBI guidelines, FPL Technologies, being a Non-Banking Financial Company (NBFC), is not directly authorized to issue credit cards. Therefore, it collaborates with these partner banks to bring to users as a co-branded credit card.

What makes stand out is its premium metal design, intuitive app-based management, and transparent fee structure — setting a new benchmark in India’s credit card market.

Unlike traditional credit cards filled with paperwork and hidden charges, This Card gives you full control through the One Card App. You can track spending, set custom limits, redeem rewards instantly, and even freeze or unfreeze your card with just a tap — all within seconds.

Benefits and Usage of One Card Credit Card

The One Card Credit Card isn’t just another plastic card—it’s designed to simplify your financial life while offering premium control and transparency. Whether you’re a first-time credit user or an experienced cardholder, ensures every feature adds genuine value to your everyday spending.

Here are the key benefits that make this card stand out:

No Hidden Fees

Say goodbye to unnecessary charges! comes with no joining fee, no annual fee, and no reward redemption fee. It’s truly lifetime free, giving you peace of mind and full transparency.

Metal Card Durability

Unlike regular plastic cards, One Card is made of metal, giving it a premium feel and long-lasting durability. It’s stylish, strong, and designed to leave an impression every time you use it.

Reward Points on Every Purchase

Earn 1 reward point for every ₹50 spent—even fractional points are counted, so you get 0.5 points for ₹25 spent. Plus, your reward points never expire, meaning you can redeem them anytime, directly from the app, without any hidden fees.

Powerful Mobile App

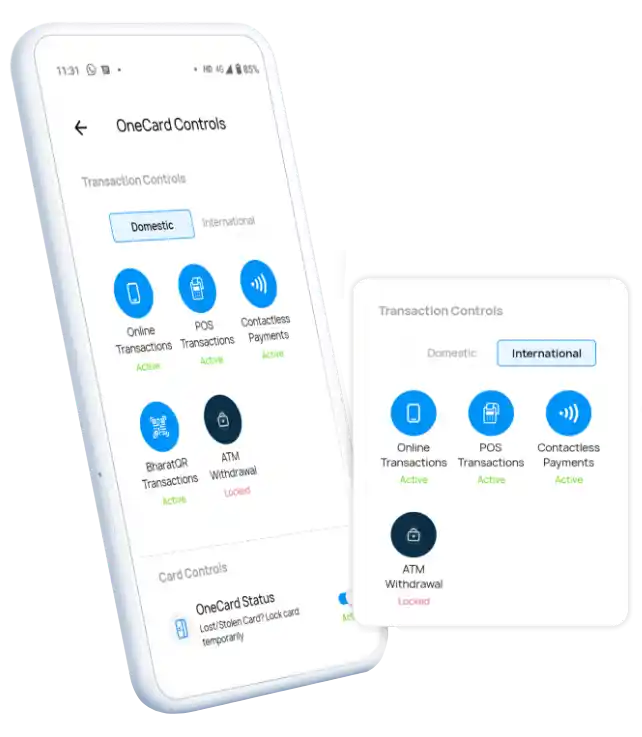

Take full control of your credit card through the One Card App. You can:

- Set or change transaction limits

- Enable or disable domestic/international usage

- Toggle online/offline or contactless payments

- Track your spends in real time

It’s simple, secure, and fully digital—perfect for users who love control at their fingertips.

Seamless Digital Onboarding

No paperwork, no waiting. You can complete the digital onboarding process in under 5 minutes and start using your virtual Card instantly—your metal card will follow soon after.

Easy EMI Conversion

Made a big purchase? No problem. lets you convert eligible transactions into EMIs instantly—no calls, no forms, no follow-ups. Just open your app, choose the transaction, and set your preferred tenure. You can even manage all your EMIs easily from the EMI Dashboard.

MyFamily Feature

Share your credit limit with your family members and let them enjoy the same benefits with their own Card. You stay in full control—tracking spends, setting limits, and managing everything from one place.

Exclusive Offers on Top Brands

Unlock special deals and discounts from leading brands in categories like shopping, dining, travel, and entertainment. This card keeps updating offers so you can enjoy more every month.

Cash Withdrawals & Interest-Free Period

You can withdraw cash from ATMs when needed, and enjoy an interest-free period of up to 48 days on your purchases—perfect for managing monthly expenses efficiently.

Eligibility Criteria for Getting a One Card Credit Card

Looking to apply for a Credit Card? Before you hit that Apply Now button, it’s smart to understand the eligibility criteria — it helps you prepare better and increases your chances of instant approval.

Also, keep in mind that frequent credit card eligibility checks across multiple banks or NBFCs can slightly impact your credit score. While one or two credit enquiries per year are perfectly fine, making too many applications at once is not advisable.

Here’s what you need to qualify for this Credit Card:

Age Limit

- Minimum Age: 18 years

- Maximum Age: 60 years

The minimum age ensures you’re legally eligible to own a credit card, while the maximum limit aligns with standard credit risk guidelines across banks.

Credit Score

A credit score of 750 or above significantly improves your chances of being approved for the metal Credit Card.

However, if you’re new to credit or don’t have a CIBIL score yet, you can still apply for an FD-backed, which doesn’t require a prior credit history.

Location

- The metal Credit Card is currently available in 67+ cities across India.

- The FD-backed version is available in 100+ locations, making it accessible to a wider audience.

Availability may vary based on your city and partner bank network.

Nationality

Applicants must be Indian citizens and residents to be eligible for Card.

Other Considerations

Eligibility can also depend on other factors such as:

- Annual income and employment status (salaried or self-employed)

- Existing debts or credit obligations

- Bank relationship with Card partner banks

By ensuring you meet these basic requirements, you can improve your chances of getting quick approval and smooth onboarding with this Credit Card.

Required Documents for a One Card Credit Card Application

Before applying for your Credit Card, make sure you have the necessary documents ready. Having them handy will help you complete the application process quickly and avoid delays or verification issues. Also, ensure that all details in your documents are accurate and up to date, as any mismatch can lead to rejection or additional verification steps.

Here’s what you’ll need:

Proof of Identity (Any One)

- Aadhaar Card

- Passport

- PAN Card

Your identity proof helps verify your name, photo, and date of birth as part of the KYC process.

Proof of Address (Any One)

- Aadhaar Card

- Utility Bill (Electricity, Gas, or Telephone)

- Rental Agreement

This ensures that your current residential address is valid and matches your application details.

Proof of Income

- Recent Salary Slips (for salaried individuals)

- Income Tax Returns (ITR) or Bank Statements (for self-employed applicants)

Your income proof helps assess your repayment capacity and determine eligibility for a credit limit.

Quick Tip:

If you’re applying for a Fixed Deposit (FD)-backed Card, you may not need to provide income proof, as the FD acts as security. However, it’s always a good idea to keep your PAN and Aadhaar ready for quick KYC verification.

How to Apply for One Card Credit Card?

Applying for the One Card Credit Card is simple, quick, and completely digital. You don’t need to visit a bank or fill lengthy forms — the entire process can be completed online in just a few minutes.

There are three easy ways to apply for One Card:

1. Through the One Card App (Recommended)

The One Card App offers the smoothest and most convenient way to apply. Here’s how:

- Download the One Card App from the Google Play Store or Apple App Store.

- Open the app and follow the on-screen instructions.

- Fill in your basic details such as name, mobile number, and PAN.

- Upload the required documents (like Aadhaar and PAN) for verification.

- Complete the online KYC process securely within the app.

If everything checks out, your virtual Card will be issued instantly in the app. The physical metal card will be delivered to your registered address as per the delivery schedule.

2. Through the Official Website

You can also apply directly on the official One Card website.

- Visit www.getonecard.app

- Click on the “Apply Now” button, or go directly to the application page

- Enter your contact details, personal details, and address

- Complete the credit assessment process online

Once approved, you’ll receive your virtual card instantly, followed by the physical metal card delivery.

3. Through the One Score App

If you want to check your credit score and eligibility before applying, the One Score App is a great starting point.

- Download the One Score App from your app store

- Open the app and fill in your details to check your credit score

- If you’re eligible, you’ll see a Credit Card offer inside the app

- Tap the offer and continue your application through the Card App

Quick Tip:

If you’re new to credit or unsure about eligibility, start with the One Score App — it helps you understand your credit profile before applying. For the fastest approval, the One Card App method is highly recommended.

Frequently Asked Questions (FAQs)

1. Can I use my Credit Card for international transactions?

Yes, absolutely. You can use your One Card Credit Card for international transactions across the globe.

Simply enable international usage from your Card App settings, and you’re ready to go.

This Card is accepted internationally and also offers a low forex markup rate, making it a convenient choice for overseas spending.

2. How can I set or manage my credit card limit?

You can set or manage credit card limit directly through the app.

3. What should I do if my Card is lost or stolen?

If your card is lost or stolen, don’t worry — you can instantly lock your card using the MyControls feature in the Card App.

If you find your card later, you can reactivate (unlock) it through the same option with just one tap.

4. What credit score do I need to get a One Card Credit Card?

A credit score of 750 or above generally increases your chances of being approved for the free metal Credit Card Credit Card.

However, even if you don’t have a credit score or have a low score, you can still apply for the FD-backed Card, which does not require prior credit history.

5. Can I withdraw cash using my Credit Card?

Yes, you can withdraw cash using the OneCash feature on your One Card Credit Card.

However, do note that cash withdrawals (cash advances) attract high interest rates, so they’re best used only in emergency situations.

Also, your cash advance limit is included within your overall credit limit.

6. Can I cancel my One Card Credit Card without paying a penalty?

Yes, you can cancel your One Card Credit Card without any penalty or closure fee.

Just make sure you clear all outstanding balances and foreclose any active EMIs before submitting your cancellation request.

7. How much money can I borrow using my Credit Card?

The amount you can borrow depends entirely on your assigned credit limit, which is determined by your credit score, income, repayment history, and other eligibility factors.

8. What is One Card UPI?

One Card UPI allows users to make UPI payments at merchant outlets directly using their credit card balance.

This feature lets your credit limit act as the source of funds for UPI-based payments — combining the convenience of UPI with the power of a credit card.

9. What is One Card’s 24×7 customer care number?

You can reach One Card Customer Care through multiple channels:

- 📞 Toll-Free Helpline: 1800 210 9111

- ✉️ Email: help@getonecard.app

- 🏢 Office Address: West Bay, Survey No. 278, Hissa No. 4/3, Pallod Farm, Phase II, Baner, Taluka Haveli, Baner Gaon, Pune – 411045, Maharashtra, India.

10. Does this offer a Virtual Card?

Yes. Along with your physical metal card, you also get a Virtual One Card, which you can use instantly for online shopping, app-based payments, and digital transactions.

11. Does this card provide airport lounge access?

Currently, One Card does not offer complimentary airport lounge access for either domestic or international terminals.

It is positioned as an entry-level lifetime free credit card, focused on offering high-value rewards and discounts on everyday categories such as shopping, dining, groceries, gadgets, and utility bills.

12. What is the difference between the Plastic One Card and the Metal One Card?

The main difference lies in the type of credit card and deposit structure:

- For FD-backed One Cards:

- If you create a Fixed Deposit below ₹50,000, you’ll receive a Plastic One Card.

- If your Fixed Deposit is ₹50,000 or above, you become eligible for the Metal One Card.

- For non-FD-based One Cards, all eligible users receive the Metal Card by default.

13. What should I do if both my mobile phone and Card are lost or stolen?

If your mobile phone or One Credit Card Credit Card is lost or stolen, the first and most important step is to file a police complaint by lodging an FIR (First Information Report).

Once you’ve done that, keep a copy of the FIR ready, as you may be asked to share it with the One Card team for verification.

You should also immediately inform One Card about the theft by sending an email to help@getonecard.app.

The support team will assist you with blocking your card and securing your account to prevent unauthorized access.

Can I change my registered email address with Card?

Yes, you can update your registered email address linked to your One Card Credit Card.

To do so, you’ll need to go through a verification process to confirm your identity and ensure account security.

You can initiate this process by contacting the support team at help@getonecard.app

15. Is the Card a contactless credit card?

Yes, the One Credit Card supports contactless payment technology.

You can simply tap your card at any enabled payment terminal to make quick and secure payments of up to ₹5,000 without entering your PIN.

This contactless transaction limit is currently applicable only within India and at terminals that accept contactless payments.

Conclusion

you’re looking for a credit card that’s not only stylish but also smartly designed for the modern user, One Card Credit Card stands out as a strong contender. With its sleek metal design, app-based controls, transparent rewards program, and no hidden charges, it truly redefines what a credit card experience should be.

Whether you’re a first-time credit card applicant or someone wanting to simplify how you manage your finances, One Card offers flexibility through both FD-backed and regular variants, giving everyone a fair chance to build or improve their credit profile.

So, if you’re ready to experience India’s smartest metal credit card, visit the official One Card website or download the OneCard app today to start your journey toward smarter spending and greater financial control.

For more such detailed reviews and guides on India’s top financial products, visit India Article.